3% DOWN WITH NO INCOME RESTRICTIONS.

BORROWERS with good income but low ON savings? FREDDIE MAC’S HomeOne MORTGAGE has a higher DTI ratio – up to 50%. You can go as high as 105 LTV/CLTV.

Homebuyers who have higher incomes but low savings may be able to buy a home with just 3% down with a Freddie Mac HomeOne® mortgage. Unlike some other low-down-payment programs, HomeOne® offers no income restrictions - even the entire down payment can be gifted.

No borrower income or geographic restrictions

No minimum borrower contribution. Zero down. - 3% down can be gifted.

97/105 LTV/CLTV

Only one borrower must be a first-time home buyer

Future employment income allowed

Maximum 50% DTI

Purchase and No-Cash-Out refinance

SFR OO, Condos and Townhomes

FICOs from 620 – only one borrower needs a score

Mortgage Insurance can be removed without refinancing

Lower down payment than FHA

Go to 105 LTV/CLTV - allows both Affordable Seconds meeting FHLMC guidelines

Available on One-Unit properties

Fixed Rate only

All borrowers must occupy subject – primary residences only

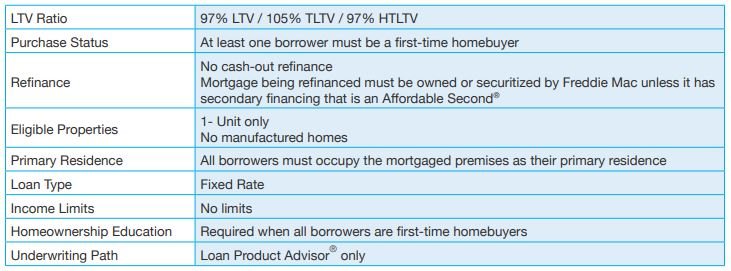

Summary of Origination and Underwriting Requirements

With more flexibility for maximum financing, HomeOne® provides expanded opportunity and greater certainty to bring more borrowers to the closing table. The HomeOne® graph below is from the Freddie Mac website: